The Canadian Securities Administrators (CSA) have published updated guidance on virtual shareholder meetings responding to concerns raised by some stakeholders regarding their experience in participating in virtual shareholder meetings, including challenges associated with accessing and participating in the virtual meetings. CSA staff are encouraging reporting issuers to provide the level and quality of shareholder participation at a virtual-only meeting that is comparable to that which a shareholder could reasonably expect if they were attending an in-person meeting.

AGM formats

The debate as to whether reporting issuers should continue to hold their shareholder meetings in a virtual-only format has reemerged as much of the world has returned to in person meetings and work. A virtual meeting may be conducted entirely virtually or through a “hybrid” format held in person while also allowing participation through electronic means.

Shareholder advocates argue that the virtual-only format allows reporting issuers to control shareholder meetings and effectively limit shareholder participation at the meetings by ignoring or curating shareholder questions submitted, by responding to questions with boilerplate statements and preventing shareholders from openly challenging management and the board. On the flip side, proponents of virtual meetings argue that shareholders rarely attend annual general meetings in person and that the virtual format increases shareholders’ engagement by providing stakeholders with an equal opportunity to engage with the issuer no matter where they live in the world.

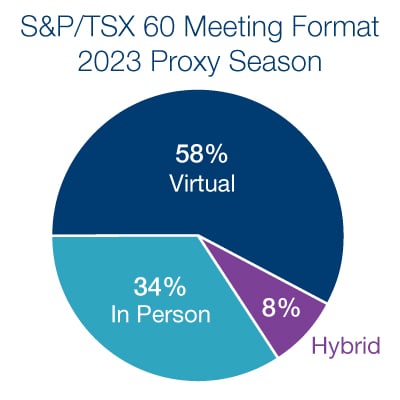

In the 2023 proxy season, we saw mixed practice with respect to meeting format; however, a majority of S&P/TSX 60 constituents continued to hold virtual-only meetings. As reporting issuers have started to file circulars for the 2024 proxy season, we continue to see mixed practice with an early preference for in-person meetings.

CSA guidance

In response to the virtual meeting question, the CSA published new guidance on February 22, 2024, which followed prior guidance published on February 25, 2022. As noted by CSA staff, one of the objectives of applicable securities law disclosure requirements is to provide shareholders with the information they need in order to understand a reporting issuer’s affairs and exercise their rights as shareholders at shareholder meetings. In order for reporting issuers to fulfil their obligations under securities legislation, it remains important that reporting issuers provide clear and comprehensive disclosure in their management information circulars and related proxy materials concerning the logistics for accessing, participating and voting at virtual shareholder meetings.

In proxy-related materials, reporting issuers can do this by providing plain language explanations of the registration, authentication and voting procedures for both registered and beneficial shareholders. CSA staff recommends that reporting issuers provide shareholders with information concerning the procedures for how shareholder questions will be received and addressed, and how shareholder participation will otherwise be accommodated and managed at the meeting. CSA staff also recommends that reporting issuers provide contact information where shareholders can obtain assistance in the event of difficulties during the registration process or while accessing and attending the meeting.

CSA staff are encouraging reporting issuers to provide for “an ease, level, and quality of shareholder participation at a virtual meeting that is comparable to that which a shareholder could reasonably expect if they were attending an in-person meeting.” Reporting issuers can facilitate shareholder participation at a virtual meeting by:

- simplifying the registration and authentication procedure;

- providing shareholders with opportunities to make motions or raise points of order;

- ensuring shareholders have the ability to raise questions and provide direct feedback to management in any question-and-answer segment of the meeting;

- indicating where shareholder proposals will be presented and voted on at the meeting, coordinating with the proponents of those proposals in advance of the meeting, and ensuring proponents are given a reasonable opportunity to speak to the proposal and respond to any questions that arise from the proposal;

- ensuring any virtual platform used by an reporting issuer has functionality permitting shareholder participation to the fullest extent possible; and

- ensuring the Chair of the meeting experienced and knowledgeable about the technological platform being used for the virtual meeting.

Reporting issuers should remember to review their governing corporate legislation and organizing documents when contemplating the format of their shareholder meetings and follow generally accepted best practices related to the conduct of virtual shareholder meetings, including considering holding “hybrid” meetings to allow both in-person and virtual participation.

Input from proxy advisors

The Canadian Coalition for Good Governance (CCGG) has published its Virtual Shareholder Meeting (VSM) Policy. Pursuant to the CCGG Policy, CCGG advocates for in-person meetings and recommends that issuers hold hybrid meetings as their default position. Such meetings facilitate both in person and online shareholder attendance, thereby preserving the option to attend in person while also providing greater access to shareholders who would not otherwise be able to attend. Issuers are encouraged to “approach virtual meetings with a shareholder engagement mindset that prioritizes simplicity of process, transparency of information and the free flow of communication”.

Glass Lewis has also published recommendations and expectations with respect to virtual-only meetings. Glass Lewis’ recommendations are generally similar to that of the CSA staff; however, Glass Lewis expands on cases where reporting issuers who choose to amend their organizing documents to allow for virtual-only or hybrid meetings. Where this is the case, reporting issuers should, at a minimum, disclose the procedure and requirements to participate in virtual only meetings at the time of calling of the meeting and institute a formal procedure for shareholders to submit questions to the board which will be answered in a format that is accessible to all shareholders. Similarly, Glass Lewis also expects reporting issuers not to amend their organizing documents to allow for the virtual participation of directors and executives unless it is limited to virtual-only meetings. The in-person attendance of executives and directors at shareholder meetings, other than virtual-only meetings, ensures that accountability to shareholders is maintained. Absent satisfaction of Glass Lewis’ disclosure expectation, the advisor will generally recommend against the chair of the reporting issuer’s governance committee.

ISS has not published a position with respect to virtual-only meetings for the 2024 proxy season.

Next Steps

As noted earlier, CSA staff have recommended in their latest guidance that reporting issuers consult and follow accepted best practices relating to the conduct of virtual shareholder meetings. Accordingly, management and the boards of reporting issuers should stay up-to-date on those best practices when considering the appropriate format for their shareholder meetings during the 2024 proxy season and beyond. In addition, in the case of contested shareholder meetings, reporting issuers should exercise great caution in selecting the appropriate format for the meeting and consult with their legal advisors on the most suitable approach before announcing the meeting and/or communicating with the dissident shareholder(s).

For the time being, it appears from the latest guidance, that CSA staff have a bias in favor of “hybrid” meetings to allow both in-person and virtual participation; however, it remains to be seen whether accepted market practice will transition to hybrid meetings or trend more towards in-person or virtual-only meetings. CSA staff have indicated that they will continue to monitor the practice of virtual shareholder meetings, including reviewing disclosure in proxy-related materials during the upcoming proxy season. Further guidance and updates may be issued, as required.