Article

ARTICLE

Canada is globally recognized for its innovative health care landscape, from its leading hospitals and research institutions to its leadership in the adoption of medtech, such as AI-enabled digital health care solutions.

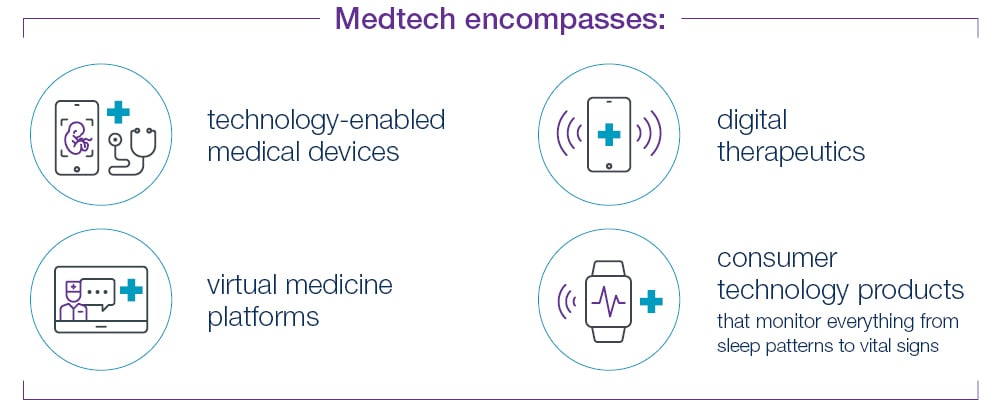

Medtech is becoming one of the fastest growing segments in Canada’s health care and life sciences sectors, particularly as COVID-19 has created a greater need for technologies that transform how health care providers leverage patient data to enable better outcomes and options.

Despite the heightened interest in medtech from both public and private markets, medtech companies—and particularly founder-led, early-stage companies—can struggle to secure and maintain funding throughout their products’ lengthy and highly regulated development life cycles. While there is no one-size-fits-all formula, some key considerations can help early-stage medtech companies navigate the uphill path to funding through product development, regulatory pathways, commercialization and launch.

The uphill path: funding options and opportunities

Early-stage medtech companies are important contributors to Canada’s innovation ecosystem, but financing remains an ongoing challenge for many.

Once an early-stage medtech company designs a product, the path to commercialization can start with seed funding, either from friends and family or from angel investors. An innovative product combined with seed funding can be the catalyst to advance to venture capital funding.

Venture capital funding

Venture capital investors are highly selective in the current environment, and investments are often based on established relationships. As a number of well-known venture investors are increasingly devoting much of their time and money to supporting promising companies in their existing portfolios, founders must be prepared, direct, transparent and strategic in their conversations with potential investors.

COVID-19 has changed how investors engage with medtech companies. Many investors clearly differentiate between companies that help health care providers meet the challenges of the pandemic—and everyone else. In response to many venture capital firms becoming more risk averse, early-stage companies are advised to seek out investors who are attuned to the post-pandemic economy, and should consider tailoring their offerings to products that are COVID-19 resistant and/or address new opportunities arising from the pandemic, such as virtual medicine.

A medtech-enabled paradigm shift in health care

A number of Canadian venture investors currently hold significant un-deployed cash positions and are motivated to engage with promising young companies. For example, the implementation of virtual engagement by physicians, hospitals and other providers has created opportunities for AI- and tech-enabled businesses to offer video telephony and online chat services to replace in-person consultations.

The pandemic has caused shifts in the dispensation of health care services and has reinforced the need for medtech services and solutions. For example, many health care providers, including family physicians, specialists and mental health professionals, are now accessible through robust virtual platforms that don’t require the patient to leave their home or office.

It was customary for patients to recover in hospital before the pandemic, a practice that drives inefficiencies and costs. The new and evolving paradigm will allow remote engagement and real time patient monitoring without requiring patients to occupy hospital beds, an expensive proposition in single- and multi-payer markets. Further, platform as a service (PaaS) allows organizations to leverage and process complex datasets to improve digital patient programs.

Attention to public and private markets

Founders should be attentive to both public and private markets. For example, the public market has not experienced the same downturn in valuations as the private market, a trend that has emerged from private investments being made in public companies. While public markets currently offer robust medtech prospects, it’s not possible for early-stage companies to accurately time windows of opportunity for product development and public-market financing. As a result, it’s imperative to anticipate how your product will weather both markets’ inevitable ebbs and flows.

Non-dilutive funding

Non-dilutive funding can be an attractive option for early-stage medtech companies—sources such as grants and government funding programs can allow founders to maintain their equity ownership while advancing their product. Government programs and scientific research tax programs can also help to ensure that your vision isn’t compromised by unfavourable funding terms. However, these initiatives offer modest funding and do not replace the need for equity funding to support the complex product development of pharmaceuticals, medical devices and related technologies.

Opportunities from strategic investors

Health care technology companies are outpacing the broader market, and have caught the attention of several global platform companies. For example, Facebook, Apple, Microsoft, Google and Amazon—also known as FAMGA— regularly monitor Canada’s tech landscape. FAMGA and other large-cap tech companies are spending substantial resources to tackle global health care challenges by leveraging innovative tech companies through R&D partnerships, licensing deals, strategic investments and acquisitions.

Funding and protecting your intellectual property

Protecting intellectual property (IP) is crucial for early-stage medtech companies for both short- and long-term goals. From a funding perspective, there is a direct relationship between a product’s IP protections and its likelihood of receiving venture capital, public market and non-dilutive funding. Robust IP protections can also help to safeguard a company against entering into an unfavourable agreement that would diminish present and future opportunities.

Mitigating risk and maximizing opportunities

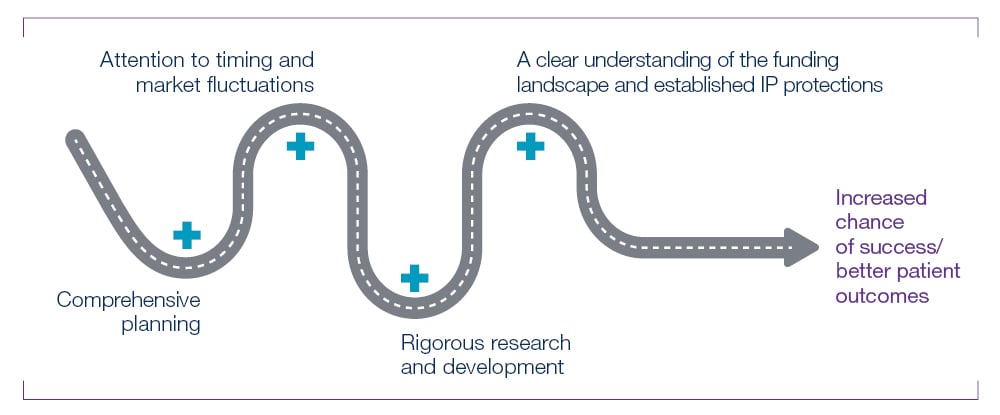

Companies of all sizes can make bad decisions, but early-stage companies are particularly vulnerable to harmful moves, such as selling licencing and distribution rights that may curtail a successful product launch. The road to commercializing a medtech product is long and subject to myriad issues, but with comprehensive planning, attention to timing and market fluctuations, rigorous research and development, a clear understanding of the funding landscape and established IP protections, an early-stage medtech company can increase its chances of success and deliver better patient outcomes.

Founder-led and more established medtech companies benefit from partnering with business and professional advisors who have a comprehensive understanding of the sector, expertise based on deep domain knowledge and established networks. BLG’s Technology Group is a national cross-sector team that can assist you throughout your product’s development cycle, from maximizing IP protection to realizing funding opportunities.

- Services: Technology

Key Contacts

-

Manoj Pundit

Partner

- Location

- Toronto

- [email protected]

- Phone

- 416.367.6577

-

Lloyd McLellan

Senior Counsel

- Location

- Calgary

- [email protected]

- Phone

- 403.232.9703

-

Beverley Moore

Partner

- Location

- Ottawa

- [email protected]

- Phone

- 613.369.4784