Article

ARTICLE

Certain merger notification thresholds under Canada’s Competition Act and foreign investment review thresholds under the Investment Canada Act (ICA) are updated on a yearly basis. Largely due to the economic effects of the COVID-19 pandemic, these thresholds have decreased for the first time for 2021.

New pre-merger notification "transaction-size" threshold under the Competition Act

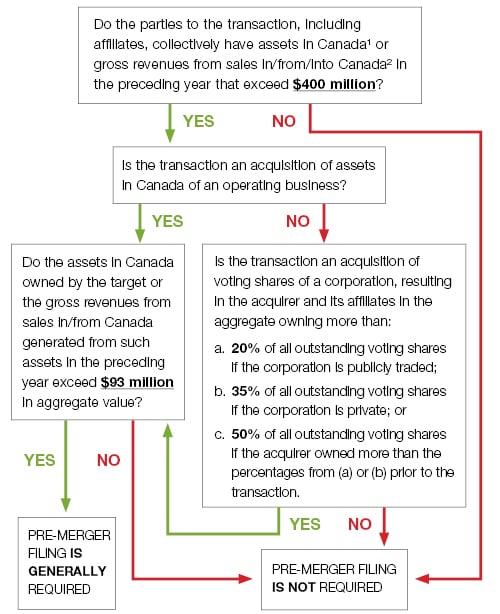

The pre-merger notification "transaction-size" threshold has decreased from the 2020 threshold of C$96 million to C$93 million for 2021. Under the Competition Act, a proposed transaction generally requires notification to the Competition Bureau, where both of the following thresholds are exceeded:

Pre-merger review thresholds for direct investments under the Investment Canada Act

The threshold for pre-merger reviews for direct investments involving the acquisition of control of Canadian, non-cultural3 businesses by WTO members (non-state owned), has decreased from C$1.075 billion to C$1.043 billion.

For non-state owned enterprise investors from any Comprehensive Economic and Trade Agreement (CETA) country, any country that has ratified the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), or any other bilateral free trade agreement partner country (now defined in the ICA as a "Trade Agreement Investor"), the threshold has decreased from C$1.613 billion to C$1.565 billion. Other Trade Agreement Investors include European Union countries, Chile, Colombia, Honduras, Japan, Mexico, New Zealand, Panama, Peru, Singapore, Vietnam, South Korea, and the United States.

The threshold for pre-merger reviews for direct investments involving the acquisition of control of Canadian non-cultural businesses by state-owned enterprises, which are controlled in WTO member states, also decreased from C$428 million to C$415 million. This threshold is based on the "book value" of the Canadian business’ assets.

The existing book value threshold of C$5 million ($50 million for an indirect acquisition) will continue to apply to acquisitions of control of cultural businesses or where no parties are from a country that is a WTO member. If these thresholds are not exceeded, the acquisition of control of a Canadian business by a non-Canadian entity is only subject to a post-closing reporting obligation (notification).

Thresholds inapplicable to national security review under the Investment Canada Act

The above thresholds do not apply to the government’s use of the national security review (NSR) process under the ICA. Under these provisions, the government can virtually review any investment of any value into Canada (by a non-Canadian), including non-controlling investments to determine whether they “would be injurious to national security”.

Citing the “unique” and “extraordinary circumstances” of the global COVID-19 pandemic, the government announced on April 18, 2020 that they will use the ICA to “subject certain foreign investments into Canada to enhanced scrutiny”, including under the NSR provisions. Please see our previous bulletin on this subject here.

1 Asset values are determined by book value (not fair market value or acquisition price) as of the date of the most recent audited financial statements, where available.

2 Gross revenues from sales of a person for an annual period are to be determined by aggregating (for that period) the amounts accruing from the sale or lease of goods.

3 A "cultural business" is defined as a business that that carries on activities in the book, magazine, periodical or newspaper industries, film/video/TV, music, or radio broadcasting industries.

- By: Denes A. Rothschild, Subrata Bhattacharjee, Devin Persaud

Key Contacts

-

Denes A. Rothschild

Partner

- Location

- Toronto

- [email protected]

- Phone

- 416.367.6350

-

Subrata Bhattacharjee

Partner and National Leader, Competition, Anti-trust & Foreign Investment Group

- Location

- Toronto

- [email protected]

- Phone

- 416.367.6371